Article 3: “GAAP vs. Tax-Basis Accounting: Which is Right for Your Business?”

(Meta Description: Confused about GAAP vs. Tax-Basis Accounting? Learn the differences, pros/cons, and how to choose the best method for your business’s financial needs.)

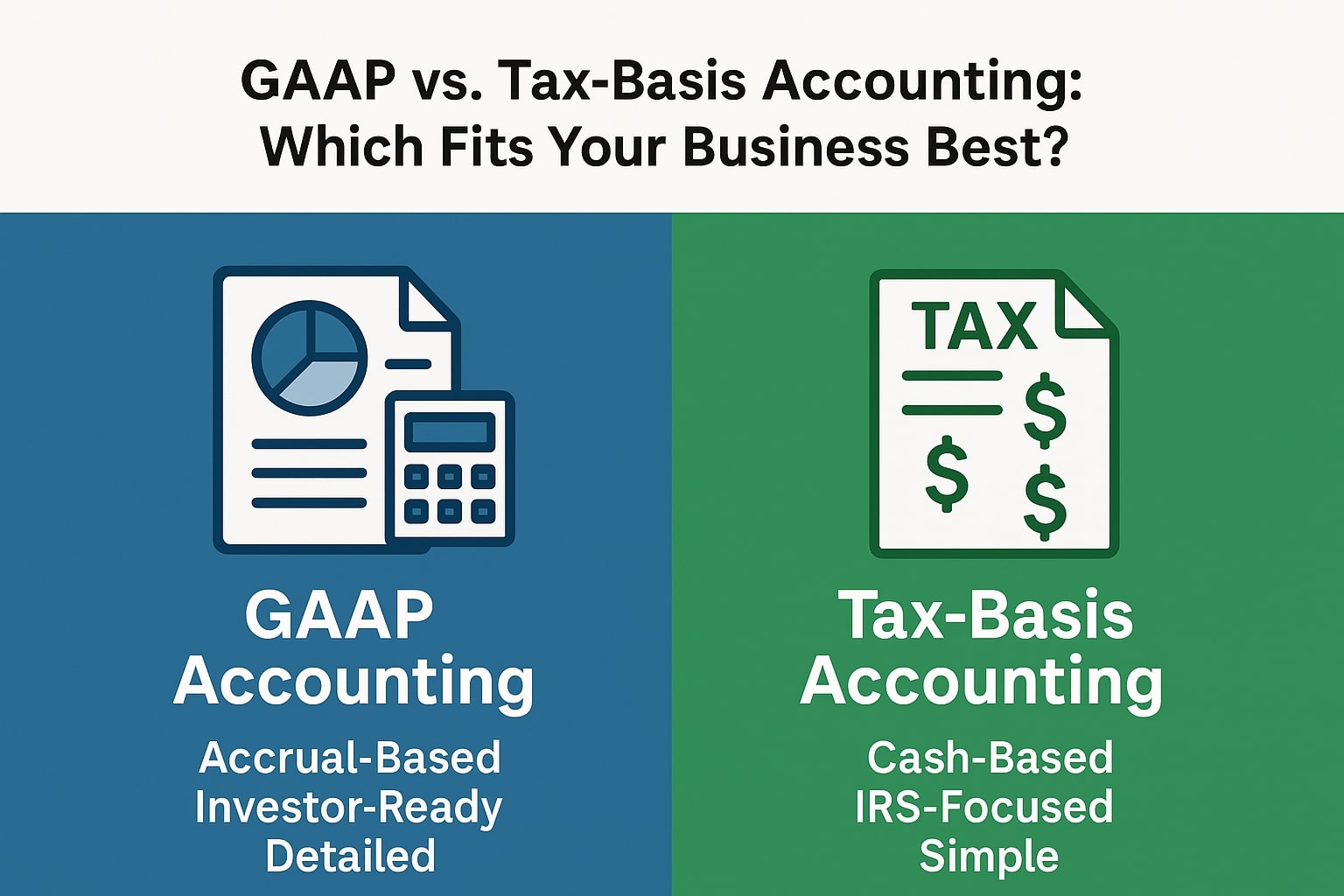

GAAP vs. Tax-Basis Accounting: Which is Right for Your Business?

Choosing the right accounting method is one of the most critical decisions for small business owners. While GAAP (Generally Accepted Accounting Principles) is the gold standard for financial reporting, many businesses opt for tax-basis accounting to simplify tax filings. But how do these frameworks differ, and which one aligns with your goals? In this guide, we’ll break down GAAP vs. tax-basis accounting, compare their pros and cons, and help you decide which method is best for your business.

What is GAAP Accounting?

GAAP is a standardized set of accounting rules established by the Financial Accounting Standards Board (FASB). It’s designed to ensure consistency, transparency, and comparability in financial statements. Key features include:

Accrual Basis: Records transactions when they’re earned/incurred (not when cash is exchanged).

Detailed Disclosures: Requires footnotes explaining financial assumptions, risks, and policies.

Complexity: Ideal for businesses seeking loans, investors, or planning to go public.

Who Uses GAAP?

Publicly traded companies (mandatory).

Businesses seeking investors or loans.

Companies preparing for audits or mergers.

What is Tax-Basis Accounting?

Tax-basis accounting follows IRS rules to calculate taxable income. It’s simpler and focuses on cash flow:

Cash or Modified Cash Basis: Records income when received and expenses when paid.

IRS Compliance: Aligns with tax return requirements (e.g., deducting expenses when paid).

Simplicity: Favored by small businesses and solopreneurs.

Who Uses Tax-Basis Accounting?

Sole proprietors, freelancers, and small LLCs.

Businesses prioritizing tax savings over detailed financial reporting.

Key Differences Between GAAP and Tax-Basis Accounting

Aspect

GAAP

Tax-Basis

Basis

Accrual basis

Cash or modified cash basis

Purpose

Investor transparency

IRS compliance

Complexity

High (detailed rules)

Low (simplified)

Expense Recognition

Matched to revenue (matching principle)

Deducted when paid

Inventory Tracking

Requires FIFO/LIFO

Often uses cash method for small businesses

Depreciation

Straight-line or accelerated methods

MACRS (IRS-approved accelerated depreciation)

Pros and Cons of GAAP

Pros:

Builds credibility with lenders and investors.

Provides a clear picture of long-term financial health.

Required for audited financial statements.

Cons:

Time-consuming and complex to implement.

May show lower short-term profits due to accruals.

Requires professional accounting expertise.

Pros and Cons of Tax-Basis Accounting

Pros:

Simple and cost-effective for small businesses.

Aligns with tax filings, reducing reconciliation work.

Can defer taxes by timing income/expenses.

Cons:

Lacks detail for strategic decision-making.

Not accepted by investors or lenders.

May misrepresent long-term profitability.

How to Choose the Right Method for Your Business

Scenario 1: You Need a Loan or Investors

Choose GAAP:

Banks and investors demand GAAP-compliant reports to assess risk. For example, accrual accounting shows accounts receivable (future income), which lenders view as an asset.

Scenario 2: You’re a Solo Entrepreneur or Small LLC

Choose Tax-Basis:

If you’re focused on tax savings and simplicity, tax-basis accounting reduces paperwork. A freelance graphic designer, for instance, can deduct software subscriptions when paid rather than tracking long-term amortization.

Scenario 3: You Want the Best of Both Worlds

Use Both Methods:

Many businesses maintain two sets of books: GAAP for financial reporting and tax-basis for IRS filings. Software like QuickBooks lets you toggle between methods.

Switching Between GAAP and Tax-Basis Accounting

Switching methods is possible but requires IRS approval (Form 3115 for tax changes). Key considerations:

GAAP to Tax-Basis: Simplify reporting but lose investor trust.

Tax-Basis to GAAP: Prepare for audits or growth but add complexity.

Tip: Work with a CPA to navigate the transition and avoid compliance issues.

FAQs About GAAP vs. Tax-Basis Accounting

Q: Can I use tax-basis accounting if I have inventory?

A: The IRS restricts cash accounting for businesses with $25M+ in annual sales (see IRS Publication 538). Smaller businesses can use cash accounting for inventory under the “small taxpayer exception.”

Q: Does GAAP affect my tax bill?

A: Indirectly. GAAP focuses on financial reporting, while tax rules dictate taxable income. You’ll need to reconcile differences (e.g., depreciation methods) when filing taxes.

Q: Which method is better for startups?

A: Startups seeking venture capital should use GAAP. Bootstrapped startups can start with tax-basis and switch later.

How to Implement Your Chosen Method

GAAP Implementation:

Use accrual-based software (e.g., QuickBooks Online).

Hire a CPA for monthly closing and disclosures.

Review FASB updates annually.

Tax-Basis Implementation:

Track cash flow with tools like FreshBooks.

Focus on IRS deadlines and deductible expenses.

Reconcile bank statements monthly.

Final Thoughts

There’s no one-size-fits-all answer to the GAAP vs. tax-basis debate. Your choice depends on your business’s size, goals, and compliance needs. While tax-basis accounting offers simplicity, GAAP unlocks growth opportunities and stakeholder trust. When in doubt, consult a CPA to align your accounting method with your long-term vision.

*(Word count: 1,400 | Primary keywords: GAAP vs. Tax-Basis Accounting, small business accounting, IRS compliance)*

SEO & Readability Tips:

Internal Links: Link to related articles (e.g., “What is GAAP?” and “Top 10 GAAP Principles”).

Header Tags: Use H2/H3 headers for scannability (e.g., “Pros and Cons,” “FAQs”).

Semantic Keywords: Include terms like “cash vs. accrual,” “IRS rules,” and “financial reporting.”